How to break up with the crippling feeling of debt

Many of us owe money. Maybe it's a mountainous heap of student loans with no “Paid in Full” letter in sight, revolving credit card debt, or medical bills that send you into a fury every time you review the itemized receipt.

Whatever the debt—and no matter how necessary or unnecessary you or society deem the investment—your “amount owed” can weigh heavily. So heavy, in fact, that it might even feel like your debt consumes or defines you. Overwhelming debt has affected people close to me, and I’ve personally carried the burden of student loans and reckless credit card spending. I’ve sat and cried with a friend with a chronic illness who’s overwhelmed and exhausted by her ever-increasing medical debt. I’ve watched a family member beat herself up over looming student loans as she betters the world around her, with her degree that cost a fortune and a job that doesn’t pay enough. I was curious to learn how debt affects us psychologically, and how to ease the weighty burden, so I sought out a financial therapist and a financial coach for insight.

Why debt happens

We live in an interesting and often frustrating economic climate in the U.S. Student loans debt is higher than ever and medical expenses are rising. Add to that an increase in rent, groceries, and necessities, along with stagnant or decreasing household incomes, and debt seems unavoidable. Still, while all of the above contribute to debt, many finance experts agree that better financial education could help significantly. “We aren't learning about the consequences of overextending our finances from a young age,” says Megan Ford, a financial therapist at the University of Georgia and president of the Financial Therapy Association. “Instead, many of us are thrust into these financial circumstances without much preparation or awareness for the consequences that can happen around high-interest borrowing.” “Additionally, many families find themselves in dire financial circumstances and are only able to support a financial emergency or daily living through credit usage," Ford continues. “If this is the only access point for funds that they have, you might understand how this can be an easy way for people to fall into debt.”

How debt affects your mind

Anyone who’s acquired even the smallest amount of debt understands just how much it can affect your world. Think about that $50 you owe a friend for dinner and how it eats at you until you’ve paid her back. When we’re talking about large sums of money owed to unforgiving corporations and banks, that weight multiplies. “For most of us, debt is similar to the corrosive effects of rust,” says Marty Martin, a behavioral finance psychologist and coach at The Planning Center, Inc. “Debt eats at us physically, psychologically, and even creates tension in our relationships.” Martin explains this is partially because people want to view themselves—and have others view them—as dependable, reliable and trustworthy. Additionally, our society values freedom and autonomy, and being indebted creates feelings of shame, constraint, and reliance on others. For some, that “inner corrosion” can be caused by the everyday stress of dealing with creditors chasing after you with threats to your financial well-being. Alternatively, the fear that you’re one expense away from delinquency, or worried about job security or a potential decrease in income, also causes stress. “In our society, if your financial well-being is threatened, then your very physical well-being is threatened,” says Martin. “These feelings can trigger anxiety, depression and sleep disturbances.”

Overcoming corrosion from the inside out

While it’s important to tackle your debt head on, taking a look at why you’re spending excessively is also necessary. For example, uncontrollable spending may be the result of deeper emotional issues, or a lack of discipline, both of which can be resolved with the help of a financial therapist. If you’re personally feeling crushed or defined by your debt, know that you aren’t alone. “Financial struggles can feel so isolating, and many of us experience a great deal of money shame, but there are often steps that we can take to get more connected to others who are sharing these circumstances,” says Ford. This includes talking with a trusted friend or colleague, joining online communities or in-person support groups, or engaging in one-on-one discussions with a knowledgeable financial therapist who can help guide you. All of the above can provide you with helpful resources and maybe even mental relief, thereby decreasing the confusion, shame, stress and anxiety surrounding your financial situation. These connections are also important in validating your contributions to the world, and in helping you realize that your debt does not create the whole of yourself. Once you’re equipped with that validation and support, you may find yourself more empowered to take control of your finances, and implement (and stick to) a plan for improvements.

Devising a debt strategy

“When we are feeling burdened and chaotic about our financial situation, this can certainly interfere with making good, planful decisions,” explains Ford. “An action plan for improving your finances is one helpful mechanism for reducing the chaos, and ultimately bettering [your] financial behavior.” To avoid feeling overwhelmed when devising a debt strategy, focus on achievable, small goals that can be met daily, weekly, and monthly. Ford says that simply writing out a bare bones plan on paper can provide relief since it’s a positive step in the right direction. Ultimately, relief comes when you get a firm hold on the reigns of your financial future. Since there’s no generalized blueprint for paying down debt, that requires a personalized plan of attack. Maybe that requires individual research on the best ways to pay off your particular debt with your particular income, or maybe you’ll feel more in control by consulting with a professional. Whatever your strategy, remember that you’re not alone and that your debt does not define you.

How debt affects your mind

Anyone who’s acquired even the smallest amount of debt understands just how much it can affect your world. Think about that $50 you owe a friend for dinner and how it eats at you until you’ve paid her back. When we’re talking about large sums of money owed to unforgiving corporations and banks, that weight multiplies. “For most of us, debt is similar to the corrosive effects of rust,” says Marty Martin, a behavioral finance psychologist, and coach at The Planning Center, Inc. “Debt eats at us physically, psychologically, and even creates tension in our relationships.” Martin explains this is partially because people want to view themselves—and have others view them—as dependable, reliable and trustworthy. Additionally, our society values freedom and autonomy, and being indebted creates feelings of shame, constraint, and reliance on others. For some, that “inner corrosion” can be caused by the everyday stress of dealing with creditors chasing after you with threats to your financial well-being. Alternatively, the fear that you’re one expense away from delinquency, or worried about job security or a potential decrease in income, also causes stress. “In our society, if your financial well-being is threatened, then your very physical well-being is threatened,” says Martin. “These feelings can trigger anxiety, depression and sleep disturbances.”

Overcoming corrosion from the inside out

While it’s important to tackle your debt head on, taking a look at why you’re spending excessively is also necessary. For example, uncontrollable spending may be the result of deeper emotional issues, or a lack of discipline, both of which can be resolved with the help of a financial therapist. If you’re personally feeling crushed or defined by your debt, know that you aren’t alone. “Financial struggles can feel so isolating, and many of us experience a great deal of money shame, but there are often steps that we can take to get more connected to others who are sharing these circumstances,” says Ford. This includes talking with a trusted friend or colleague, joining online communities or in-person support groups, or engaging in one-on-one discussions with a knowledgeable financial therapist who can help guide you.

All of the above can provide you with helpful resources and maybe even mental relief, thereby decreasing the confusion, shame, stress and anxiety surrounding your financial situation. These connections are also important in validating your contributions to the world, and in helping you realize that your debt does not create the whole of yourself. Once you’re equipped with that validation and support, you may find yourself more empowered to take control of your finances, and implement (and stick to) a plan for improvements.

Devising a debt strategy

“When we are feeling burdened and chaotic about our financial situation, this can certainly interfere with making good, planful decisions,” explains Ford. “An action plan for improving your finances is one helpful mechanism for reducing the chaos, and ultimately bettering [your] financial behavior.” To avoid feeling overwhelmed when devising a debt strategy, focus on achievable, small goals that can be met daily, weekly, and monthly. Ford says that simply writing out a bare bones plan on paper can provide relief since it’s a positive step in the right direction. Ultimately, relief comes when you get a firm hold on the reigns of your financial future. Since there’s no generalized blueprint for paying down debt, that requires a personalized plan of attack. Maybe that requires individual research on the best ways to pay off your particular debt with your particular income, or maybe you’ll feel more in control by consulting with a professional. Whatever your strategy, remember that you’re not alone and that your debt does not define you.

Uncontrollable spending may be the result of deeper emotional issues.

Wendy Rose Gould

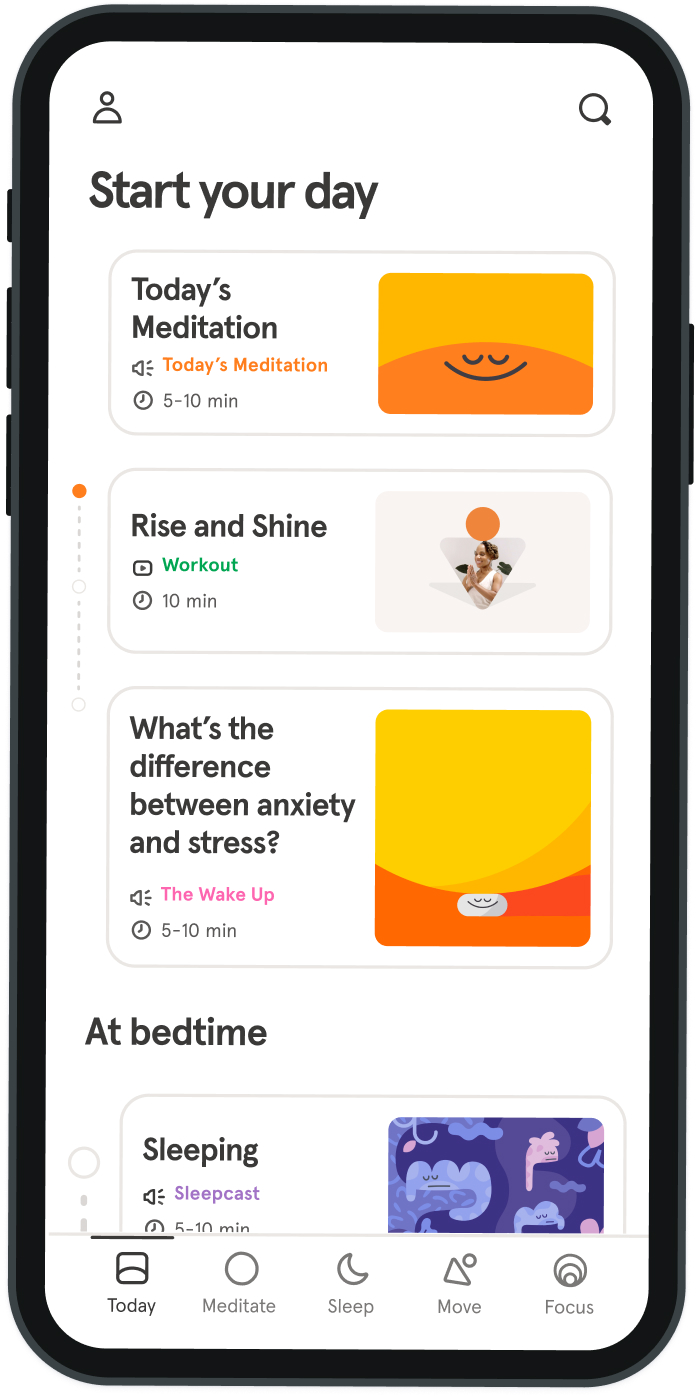

Be kind to your mind

- Access the full library of 500+ meditations on everything from stress, to resilience, to compassion

- Put your mind to bed with sleep sounds, music, and wind-down exercises

- Make mindfulness a part of your daily routine with tension-releasing workouts, relaxing yoga, Focus music playlists, and more

Meditation and mindfulness for any mind, any mood, any goal

Stay in the loop

Be the first to get updates on our latest content, special offers, and new features.

By signing up, you’re agreeing to receive marketing emails from Headspace. You can unsubscribe at any time. For more details, check out our Privacy Policy.

- © 2025 Headspace Inc.

- Terms & conditions

- Privacy policy

- Consumer Health Data

- Your privacy choices

- CA Privacy Notice